The MAN who turns Hit$ into Million$

ABDUL-JALIL, without ever attending Law School, negotiated a series of Pro Sports Player contracts that included many unprecedented benefits to the individual clients, one of which was interest-free loans that could be forgiven. Upon review by the Internal Revenue Service, the contracts and tax returns where thrown out, challenged by the IRS, and the IRS filed suit.

After an eight (8) year legal battle, Jalil prevailed in Federal Tax Court, wherein his case established that Interest free Loans with forgiveness were in fact legal. This unprecedented legal ruling MADE NEW LAW, establishing a NEW standard in the Federal Tax Laws, was acknowledged in several National Law Journals, Cite: “IRS vs Al-Hakim”, published by Commerce Clearing House(CCH) Tax Court Memorandum Cases editions KF 6234A 505, Maxwell McMillian (Prentice Hall) Federal Tax Cases edition KF 6234A 512 Tax Court Memorandum Decisions, Articles and citations available upon request……. The Historic “al-Hakim” Tax Code §7872 [692] Ruling.

After al-Hakim’s victory in the Federal Tax Courts against the Tax Commissioner, in December 2000 the IRS moved to change the Federal Tax Codes such that it now “prevents no-interest loans”, was instituted to eliminate and close the Federal Income Tax loop-hole created with al-Hakim’s use of interest free loans in sports and entertainment financial transactions, CITE: Tax Notes December 4, 2000 p. 1311; 89 Tax Notes 1311 (Dec. 4, 2000) “al-Hakim Tax Code” Ruling.

al-Hakim’s victory in the Federal Tax Court over the U. S. Tax Commissioner has the nations foremost academicians and Top Major U.S. Colleges and Universities academic institutions Programs for Juris Doctorate Law (JD) and Masters in Business Administration (MBA) degrees featuring his cases instructing classes in the study of Contracts, Finance, Interest, Loans, Reserve/Free Agency System and Restraint of Trade, Sherman Anti-trust Act (15 USC § 1,2), NLRA, Labor Exemption from Antitrust Law, Collective Bargaining, Labor law, Antitrust, Federal Arbitration, Civil Rights, and his cases has made “Law Review”, setting New Law in four different areas, published in over Seven Universities Law Reviews, Scholarly Commons, multiple Course Outlines, Student Journals, in the specialty area of Contracts, Finance, Interest, Loans, Reserve/Free Agency System and Restraint of Trade, Sherman Anti-trust Act, (15 USC § 1,2), NLRA, Labor Exemption from Antitrust Law, Collective Bargaining, Labor law, Antitrust, Federal Arbitration, Civil Rights, Insurance.

The worlds most highly acclaimed professors in such hallowed halls as Harvard University Law and Business School- MBA, Yale University Law and Business School- MBA, Washington University Law and Business School- MBA, Stanford University Law and Business School- MBA, University of Virginia Law and Business School, among others, are teaching al-Hakim’s use of interest free loans with forgiveness as part of their Law and Business curriculum presenting the Tax Free financial considerations of transactions as part of the ISLAMIC AND JEWISH PERSPECTIVES ON INTEREST, examining al-Hakim’s historic impact on Shariah-Riba Complaint financial transactions in the business world, discusses financial transactions that allow devout Muslims and Jews to obey religious prohibitions against interest, while giving investors a return on their investments, The tax treatment of these transactions is considered an integral part of al-Hakim’s cases.

The REAL impact and importance of the 1977 contacts that lead to the Historic “al-Hakim” Tax Code Ruling of 2000 can not be more profoundly expressed than to understand that it is the financial BLUEPRINT for the “Too Big to Fail” Financial Bailout of 2008 and the PPP/SBA Loans under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and Paycheck Protection Program (PPP) 2020.

President Barack Obama, The Federal Government and IRS Acknowledges the Economic Impact of the Historic “al-Hakim” Interest-Free Loan with Forgiveness in “Too Big to Fail” Bailout of 2008

“Too Big to Fail” describes a business or business sector deemed to be so deeply ingrained in a financial system or economy that its failure would be disastrous to the economy. Therefore, the government will consider bailing out the business or even an entire sector—such as Wall Street banks or U.S. carmakers—to prevent economic disaster.

Then the Wall Street stock market crash occurred on September 29, 2008 as the Dow Jones Industrial Average fell by 777.68 points in intraday trading. The financial crisis had its origins in the housing market, for generations the symbolic cornerstone of American prosperity, was a result of defaults on consolidated mortgage-backed securities (MBS). Subprime housing loans comprised most MBS. Banks offered these loans to almost everyone, even those who weren’t creditworthy. When the housing market fell, many homeowners defaulted on their loans.

The market crashed, partly, because Congress initially rejected the Emergency Economic Stabilization Act of 2008, popularly known as the bank bailout bill. But the stresses that led to the crash had been building for a long time.

On October 9, 2007, the Dow hit its pre-recession high and closed at 14,164.53. By March 5, 2009, it had dropped by more than 50% to 6,594.44.2 Although it wasn’t the greatest percentage decline in history, it was vicious.

The stock market fell nearly 90% during the Great Depression. But that took almost four years. The 2008 crash only took 18 months.

Financial stresses peaked following the failure of the US financial firm Lehman Brothers in September 2008. Together with the failure or near failure of a range of other financial firms around that time, this triggered a panic in financial markets globally, a global financial crisis (GFC). Investors began pulling their money out of banks and investment funds around the world as they did not know who might be next to fail and how exposed each institution was to subprime and other distressed loans. Consequently, financial markets became dysfunctional as everyone tried to sell at the same time and many institutions wanting new financing could not obtain it. Businesses also became much less willing to invest and households less willing to spend as confidence collapsed. As a result, the United States and some other economies fell into their deepest recessions since the Great Depression.

Until September 2008, the main policy response to the crisis came from central banks that lowered interest rates to stimulate economic activity, which began to slow in late 2007. However, the policy response ramped up following the collapse of Lehman Brothers and the downturn in global growth.

Central banks lowered interest rates rapidly to very low levels (often zero); lent large amounts of money to banks and other institutions with good assets that could not borrow in financial markets; and purchased a substantial amount of financial securities to support dysfunctional markets and to stimulate economic activity once policy interest rates were at or near zero (known as ‘quantitative easing’).

The Emergency Economic Stabilization Act of 2008, followed the failure of banks during the financial crisis of 2007-2008, included the $700 billion Troubled Asset Relief Program (TARP) as governments increased their spending to stimulate demand and support employment throughout the economy; guaranteed deposits and bank bonds to shore up confidence in financial firms; and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could have exacerbated the panic in financial markets. The American Recovery and Reinvestment Act (ARRA) also provided Economic Impact Payments (Stimulus) of up to $1,400 direct payments each per adult for eligible individuals and $500 per qualifying child under age 17.

Although the global economy experienced its sharpest slowdown since the Great Depression, the policy response prevented a global depression. Nevertheless, millions of people lost their jobs, their homes and large amounts of their wealth. Many economies also recovered much more slowly from the GFC than previous recessions that were not associated with financial crises. For example, the US unemployment rate only returned to pre-crisis levels in 2016, about nine years after the onset of the crisis.

Presidents Trump and Biden, The Federal Government and IRS Acknowledges the Economic Impact of the Historic “al-Hakim” Interest-Free Loan with Forgiveness in PPP and SBA Loans under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and Paycheck Protection Program (PPP) 2020

The HEROES Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act

The $3 Trillion HEROES Act was sweeping relief legislation promises a second stimulus check, debt relief, student loan forgiveness, hazard pay, six more months of COVID-19 unemployment, housing and food assistance, and nearly $1 trillion in aid for state and local governments so they can pay “vital workers like first responders, health workers, and teachers” who are at risk of losing their jobs due to budget shortfalls.

The HEROES Act also makes changes to the federal government’s new Paycheck Protection Program for small businesses. The plan currently requires small businesses to use 75% of the money for payroll expenses, or be forced to pay it back as a loan.

The new proposal eliminates the 75% requirement, so small businesses could use the money as they pleased. In a classic case of unintended consequences, many businesses found they couldn’t use the money on payroll. Their employees didn’t want to be put back on the payroll because they were making more from COVID-19 unemployment.

Stimulus Check

The HEROES Act includes a one-time stimulus check payment, similar to the CARES Act, of $1,200 per person up to $6,000 per household, but with several more generous features.

Individuals earning up to $75,000 would get a one-time $1,200 check. Couples earning up to $150,000 would be eligible for $2,400.

The HEROES Act pays $1,200 for each dependent (up to three dependents), more than double the CARES Act payment (which paid $500 per dependent), and allows adult dependents.

The first round of stimulus checks excluded adult dependents, which excluded many college students and immigrants. People without a Social Security number were excluded from the first round of checks. The HEROES Act says all you need is a taxpayer ID number. Republicans aren’t excited over that.

Hazard Pay

The HEROES Act sets aside $200 billion for hazard pay. Hazard pay would be:

- Given to a wide variety of “essential” workers, including doctors, nurses and other frontline medical personnel, police officers, firefighters, social workers, grocery clerks, postal workers, and childcare and cafeteria workers.

- A $13-an-hour raise paid until workers receive a total of $10,000 if their regular pay is less than $200,000 per year. Or up to $5,000 total if they make more than $200,000 a year.

- Paid for 60 days after the pandemic ends if the $10,000 or $5,000 totals aren’t reached first.

- Distributed by employers, who will apply to the government for hazard pay, add it to their workers’ paychecks, deduct payroll taxes from all hazard payments.

Unemployment Benefits

The HEROES Act would extend the unemployment benefits from the CARES Act, including the extra $600 weekly federal unemployment benefit, through January 31, 2021. If you’re already receiving Federal Pandemic Unemployment Compensation (FPUC), your payments could be extended to March 31, 2021.

Gig workers, independent contractors, part-time workers and the self-employed will also be able to take advantage of unemployment benefits through March 2021.

Student Loan Forgiveness

The CARES Act suspended interest and payments for most people with federal student loans through September 30, 2020. Interest will not accrue during that period. The HEROES Act extends that break for another, year through September 30, 2021, and expands it to all federal student loans, including Federal Perkins Loans and some other loans

But the legislation also cancels up to $10,000 for some federal and private loan holders. Democrats scaled this back from a proposed $30,000 in canceled student loan debt.

The HEROES Act also proposes direct emergency cash payments for financially struggling students, including international students, undocumented immigrant students, and DACA students.

Don’t expect Republicans to do cartwheels over any of it.

Rental Aid

America’s 40-million-plus renters were overlooked by the CARES Act. Not so the HEROES Act, which provides approximately $100 billion for rental assistance.

Here’s how it would work: An existing nationwide grant rental assistance program would verify a tenant’s inability to pay rent and give vouchers to cover the cost of rent and utilities.

It would also extend the ban on evictions for nonpayment for a year following its enactment date.

Mortgage Relief

The bill also provides $75 billion for a homeowner assistance fund intended to prevent mortgage defaults and property foreclosures.

It would amend the previous stimulus package so that borrowers of any “covered mortgage loan” (any secured by a mortgage or deed of trust on one-to-four unit dwelling) would be eligible for forbearance for up to a year if they affirm that the coronavirus has affected them financially.

Previously, only borrowers of federally backed mortgages were eligible for 12 months of forbearance. The legislation also provides a national foreclosure and eviction moratorium for one year, and extends benefits to mortgage servicers, who naturally struggle when the government says they can’t collect mortgage payments.

Debt Collection Freeze

Don’t get your hopes up for some magic proposal that stops the debt collector in his tracks.

The HEROES Act includes a moratorium on debt collections during the pandemic and 120 days thereafter. Democrats realize this would all but destroy the debt collection business.

So, to make the whole idea more palatable to Republicans, Democrats, usually no fans of debt collectors, included long-term, low-cost loans for debt collectors to compensate them for being denied collecting their debts.

But there’s no way Republicans agree to a moratorium on debt collections, and no way Democrats agree to helping out debt collectors without a moratorium.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act

The U.S. Congress passed a $2.2 trillion stimulus bill called the Coronavirus Aid, Relief, and Economic Security Act (CARES) in March 2020 to blunt the economic damage set in motion by the global coronavirus pandemic.

The Paycheck Protection Program (“PPP”) was a federal program that paid out $790.9 billion in small business loans during the COVID-19 pandemic in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for everyone and the loan amounts will be forgiven as long as the loan proceeds are used to cover payroll.

The Paycheck Protection Program (PPP) and State Small Business Credit Initiative (SSBCI) loans were made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement:

- Employee and compensation levels are maintained,

- The loan proceeds are spent on payroll costs and other eligible expenses, and

- At least 60% of the proceeds are spent on payroll costs.

The Employee Retention Credit under section 2301 of the CARES Act, as amended by sections 206 and 207 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (additional Guidance on the Employee Retention Credit under Section 2301 of the Coronavirus Aid, Relief, and Economic Security Act and Guidance on the Employee Retention Credit under the CARES Act for the First and Second Calendar Quarters of 2021 are both available from the IRS), and the Employee Retention Credit under section 3134 of the Internal Revenue Code of 1986, as enacted by the American Rescue Plan of 2021. (Note that reporting these qualified wages in the payroll costs entered on your loan forgiveness application will affect the amount of qualified wages that can be used to claim the employee retention credit.)

A PPP borrower can apply for forgiveness once all loan proceeds for which the borrower is requesting forgiveness have been used. Borrowers can apply for forgiveness any time up to the maturity date of the loan. If borrowers do not apply for forgiveness within 10 months after the last day of the covered period, then PPP loan payments are no longer deferred, and borrowers will begin making loan payments to their PPP lender.

There also was the American Rescue Plan Act of 2021 (American Rescue Plan) that provided THREE (3) rounds of Economic Impact Payments (Stimulus) of up to $1,400 direct payments each for eligible individuals or $2,800 each for married couples filing jointly, plus $1,400 for each qualifying dependent, including adult dependents.

The REAL impact and importance of the 1977 contacts that lead to the Historic “al-Hakim” IRS Tax Code Ruling of 2000 IS ALIVE AND WELL TODAY!

Abdul-Jalil’s cases are taught in ALL MAJOR University Juris Doctorate in Law and Maters in Business Administration Curriculums Courses in Federal Income Taxation, Contracts, Salary Grievances/Disputes, Federal Arbitration, Labor Law, Collective Bargaining Labor Agreements, Civil Rights, Employment, Compensation, Interest Free Loans, Rates of Compensation, wherein his Legal Impact has CHANGED BUSINESS, SPORTS, ENTERTAINMENT and THE WORLD!

~ Harvard University School of Law Federal Income Taxation Course Outline, Professor: Flusche, al-Hakim’s victory, in the Federal Tax Court, U. S. Tax Commissioner teaching al-Hakim’s use of interest free loans, Tax Free financial transactions, al-Hakim’s historic impact on Shariah-Riba Complaint financial transactions in the business world,

~ Yale University School of Law Federal Tax Course, Professor: Eric M. Zolt, Text Authors: William A. Klein, Joseph Bankman, Daniel N. Shaviro,

~ Wake Forest University School of Law, Winston Salem, North Carolina, Federal Tax Course on “ISLAMIC & JEWISH PERSPECTIVES ON INTEREST”, Author/Professor: Joel S. Newman, Federal Tax Court, U. S. Tax Commissioner, discusses financial transactions that allow devout Muslims and Jews to obey religious prohibitions against interest, while giving investors a return on their investments, The tax treatment of these transactions is considered, teaching al-Hakim’s use, interest free loans, Tax Free financial transactions, al-Hakim’s historic impact, Shariah, Riba, Complaint financial transactions, the business world,

~ University of Virginia School of Law Federal Tax Course, Professor: M. Robinson, Federal Income Taxation, L. Dominick, Text Authors: William A. Klein, Joseph Bankman, Daniel N. Shaviro,

~ Washington University School of Law Federal Tax Course, Professor: Bixby,

~ Washington & Lee University School of Law Federal Tax Course,

~ Weiler Sports Law, LSE, Labor Arbitration in Professional Sports, The History and Legal Authority of the Sports League Commissioner

~ “A Long Deep Drive to Collective Bargaining, Of Players, Owners, Brawls, and Strikes”, Robert C. Berry, William B. Gould, Student Journals at Case Western Reserve University School of Law, Scholarly Commons, Individual v. Collective Interests, Case Western Reserve, Law Review, Volume 31 Summer 1981, CASES, PUBLISHED, UNIVERSITIES, LAW REVIEWS, ENTERTAINMENT, SPORTS, COURSE, OUTLINES, PUBLICATIONS, Case, Western, Reserve, Law, Review,

~ University of Texas School of Law, Course Title: LAW 111, Agent Representation

~ University of Massachusetts- Amherst, Major League Baseball’s Grievance Arbitration System, Glenn M. Wong, Professor of Sports Law, Entertainment and Sports Law, Marquette University School of Law, Entertainment and Sports Law Commons Journals,

~ Marquette Law Scholarly Commons, Interpreting the NFL Player Contract, Professor Gary R. Roberts, Marquette Sports Law Review,

~ Vanderbilt University School of Law, Sports Law, Knight Commission, purpose was to examine NCAA athletics and make recommendations, Professor Joseph Fishman, Studocu,

~ University of Nevada-Las Vegas, William S. Boyd School of Law, Course, Sports Law, Competition Law, National Collegiate Athletic Association, Professor Marc Kligman, Adjunct, Sports Law, University of Nevada William S. Boyd School of Law, UNLV 87169927,

~ Santa Clara University School of Law, Legal Professions: Sports Law, The Role of the Commissioner and Other Governing Authorities, Professor Alan W. Scheflin, Santa Clara Law,

~ Quimbee Law School Case Briefs, Overview, Casebooks, study aids, BAR Review, online Continuing Legal Education, CLE courses, Alvin Moore vs Atlanta Braves, Major League Baseball Arbitration Proceeding, MLB-MLBPA Arb. 77-18 (1977), Professor A. Porter,

~ Course Hero Sports Law Outline, 1968 Major League Baseball (MLB) Basic Agreement, made the Commissioner the arbitrator, clearly allowing for arbitration of reserve system grievances,

~ Quizlet, Sports Law 1-3, Alvin Moore & Atlanta Braves (1977),

~ Judd’s Sports Law Outline, SPORTS LAW OUTLINE, Chapter, Best Interests of the Sport: The Role of the Commissioner and Other Governing Authorities,

~ NetSuite Inc, Alvin Moore & Atlanta Braves, Arbitration as an Exclusive Remedy, § 301 Preemption, ABDUL-JALIL, Sports and Entertainment Law Cases in All Major College’s Juris Doctorate Law (JD) and Masters in Business Administration (MBA) Programs, MBA Programs,

~ Harvard University Business School- MBA,

~ Yale University Business School- MBA,

~ Washington University Business School- MBA,

~ Stanford University Graduate School of Business Management- MBA,

~ University of Virginia Graduate School of Business- MBA,

LECTURER AND PRESENTER IN THE FIELDS OF:

~ Music in Islam, University of California, Berkeley, CA 2003

~ National Islamic Convention, Seacaucus., NJ 1997,

~ Host/Honoree: Evening of Elegance, National Arabic Conference, Oakland, CA. 1997,

~ National Islamic Convention, N.Y.C, N.Y. 1996,

~ International Islamic Conference, Los Angeles, CA. 1996,

~ Oaktown Music Conference, Oakland, CA 1996,

~ National Society of Black Engineers Conference-Region 6, San Luis Obispo, CA. 1992,

~ CAREER FEST, Oakland, CA. 1986,

~ California State University, Hayward, CA. 1985,

~ United States Coast Guard, Oakland, CA. 1982,

~ National BALSA Law Conference, Houston, TX 1981,

~ National BALSA Law Conference, Philadelphia, PA. 1982,

~ National BALSA Law Conference, Oakland, CA. 1979,

~ National BALSA Law Conference, N.Y.C., N.Y. 1980,

~ Mountain Regional Law Convention, Oklahoma City, OK. 1980,

~ College of Alameda, Alameda, CA. 1981,

~ Eastern Regional Law Conference, Washington D.C. 1980,

~ National Black Media Convention, Oakland, CA. 1972,

~ National BALSA Law Conference, Washington D.C. 1976,

~ Pacific Coast Law Conference, San Francisco, CA. 1976,

~ Stanford Law Society, Palo Alto, CA. 1976,

~ National Black History Week Awards, San Francisco, CA, 1974,

~ Hip-Hop/Raps influence on Societal America, The Stevenson School, Pebble Beach, CA 2010

MASTERS CLASSES IN THE FIELDS OF:

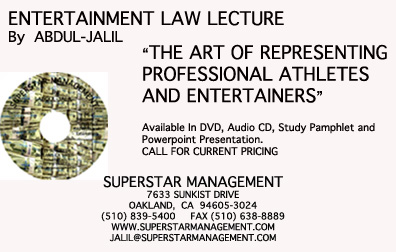

~ SPORTS AND ENTERTAINMENT LAW*

~ THE ART OF REPRESENTING PROFESSIONAL ATHLETES AND ENTERTAINERS*

~ REPRESENTING THE PRODUCER*

~ REPRESENTING THE DIRECTOR*

~ REPRESENTING THE SUPERSTAR*

~ GETTING MONEY FOR YOUR MOVIE*

~ LICENSING MOTION PICTURES*

~ DIGITAL MOVIEMAKING*

~ THE BUSINESS OF SPORTS*

~ THE BUSINESS OF ENTERTAINMENT*

~ SPORTS AND ENTERTAINMENT MARKETING*

~ ADVERTISING, MARKETING, PROMOTION, SPONSORSHIPS, BRANDING AND HIP HOP CULTURE

~ HIP HOP AND THE SPREAD OF ISLAM*

~ ISLAM AND MUSIC*

Washington University School of Law Federal Tax Course,

Washington University School of Law Federal Tax Course,

Professor: Bixby;

Yale University School of Law Federal Tax Course,![]()

Professor: Eric M. Zolt

Text Authors: William A. Klein, Joseph Bankman, Daniel N. Shaviro; University of Virginia School of Law Federal Tax Course,

University of Virginia School of Law Federal Tax Course,

Professor: M. Robinson * Federal Income Taxation * L. Dominick

Text Authors: William A. Klein, Joseph Bankman, Daniel N. Shaviro;

Washington & Lee University School of Law Federal Tax Course,

Harvard University School of Law Federal Income Taxation Course Outline,

Harvard University School of Law Federal Income Taxation Course Outline,

Professor: Flusche

al-Hakim’s victory in the Federal Tax Court over the U. S. Tax Commissioner has academians teaching al-Hakim’s use of interest free loans in Tax Free financial transactions as part of a Wake Forest University School of Law Federal Tax Course on “ISLAMIC AND JEWISH PERSPECTIVES ON INTEREST” and al-Hakim’s historic impact on Shariah-Riba Complaint financial transactions in the business world.

Wake Forest University School of Law Tax Course on “ISLAMIC & JEWISH PERSPECTIVES ON INTEREST”,

Author/Professor: Newman, Joel S.

al-Hakim’s victory in the Federal Tax Court over the U. S. Tax Commissioner has academians teaching al-Hakim’s use of interest free loans in Tax Free financial transactions as part of the Wake Forest University School of Law Federal Tax Course on “ISLAMIC AND JEWISH PERSPECTIVES ON INTEREST” and al-Hakim’s historic impact on Shariah-Riba Complaint financial transactions in the business world.

Joel S. Newman is a professor at Wake Forest Law School, Winston Salem, North Carolina.

In this report, Newman discusses financial transactions that allow devout Muslims and Jews to obey religious prohibitions against interest, while giving investors a return on their investments. The tax treatment of these transactions is considered. An integral part is al-Hakim’s case.

1977-

The Historic BALSA 1979 National Law Convention The historic Black American Law Students Association, 11th Annual National Convention, March 28-April 1, 1979, Hyatt, Oakland, was themed: “The Reconstruction of Black Civilizations.” Dedicated to- Rev. Ben Chavis of the Wilmington Ten, Introduction- Mayor Lionel Wilson, Keynote Speaker- Min. Louis Farrakhan, with veritable “Who’s Who” of nations leading Black presenters: Junius Williams-Pres. NBA, Hon. Ben Travis, Abdul-Jalil al-Hakim, Don Warden (Khalid al-Mansour), Dave Wilmont-Georgetown Law Center; Howard Moore, Alfred Slocum- Rutgers School of Law, Angela Davis, Victor Goode- Ex. Dir. NCBL, Hon. Judith Ford, Herb Reed- Howard School of Law, Asa Hilliard, Nathan Hare, Ron Baily- Northwestern University, Michael Ashburne, David Hall- FTC, Denice Carty Bernia- North Eastern University; Moot Court Judges: Hon. Wiley Manuel, Hon. Clinton White, Hon. David Cunningham, Hon. Allen Broussard, with “Thanks” to -John Burris, Peter Cohen, Claude Ames, Robert Harris, Eva Patterson, George Holland.

CASES PUBLISHED IN UNIVERSITIES LAW REVIEWS, ENTERTAINMENT AND SPORTS COURSE OUTLINES AND PUBLICATIONS on ALVIN MOORE LANDMARK LEGAL CASE

Case Western Reserve Law Review Volume 31 Summer 1981 Number 4

A Long Deep Drive to Collective Bargaining: Of Players, Owners, Brawls, and Strikes.

Professor Robert C. Berry, Professor William B. Gould

Student Journals at Case Western Reserve University School of Law Scholarly Commons

University of Massachusetts- Amherst

Major League Baseball’s Grievance Arbitration System

by Glenn M. Wong, Professor of Sports Law

Entertainment and Sports Law

***********

Marquette University School of Law

Entertainment and Sports Law Commons Journals at Marquette Law Scholarly Commons

Interpreting the NFL Player Contract

Professor Gary R. Roberts

Marquette Sports Law Review- Volume 3, Issue 1, Article 5, Fall

***********

Vanderbilt University School of Law

Sports Law – Knight Commission: purpose was to examine NCAA athletics and make recommendations

Professor Joseph Fishman

Studocu

***********

University of Nevada-Las Vegas William S. Boyd School of Law

Course: Sports Law: Competition Law | National Collegiate Athletic Association

Professor Marc Kligman, Adjunct. Sports Law

University of Nevada William S. Boyd School of Law

UNLV 87169927

***********

Santa Clara University School of Law

Legal Professions: Sports Law

The Role of the Commissioner and Other Governing Authorities

Professor Alan W. Scheflin – Santa Clara Law

***********

Quimbee Law School Case Briefs, Overview, Casebooks, study aids, BAR Review, and online Continuing Legal Education (CLE) courses

Alvin Moore vs Atlanta Braves

Major League Baseball Arbitration Proceeding

MLB-MLBPA Arb. 77-18 (1977)

Professor A. Porter

***********

Course Hero Sports Law Outline

1968 Basic Agreement made the Commissioner the arbitrator clearly allowing for arbitration of reserve system grievances.

University of Texas School of Law

Course Title: LAW 111

6) Agent Representation – The collective agreement plays the ultimate governing role

Quizlet, Sports Law 1-3

Alvin Moore & Atlanta Braves (1977)

***********

Judd’s Sports Law Outline

SPORTS LAW OUTLINE

Chapter 1 – Best Interests of the Sport: The Role of the Commissioner and Other Governing Authorities

***********

NetSuite Inc:

Alvin Moore & Atlanta Braves …

D. Arbitration as an Exclusive Remedy; § 301 Preemption

***********

Weiler Sports Law 6th ACB LSE

Labor Arbitration in Professional Sports

The Early Years (Pg 85)

The History and Legal Authority of the Sports League Commissioner

Arbitration of Disciplinary Disputes

Chapter 3. Labor Arbitration in Professional Sports……………………. 121

A. Contract Interpretation Through Arbitration ………………………….. 123

Alvin Moore & Atlanta Braves …………………………………………….. 124

Notes and Questions …………………………………………….… 126

***********

Studocu

Vanderbilt University School of Law

Sports Law- The Knight Commission

Purpose was to examine NCAA athletics and make recommendations

Professor Joseph Fishman

LECTURER AND PRESENTER IN THE FIELDS OF: *ENTERTAINMENT LAW*

*ENTERTAINMENT LAW*

*THE ART OF REPRESENTING PROFESSIONAL ATHLETES AND ENTERTAINERS*

*REPRESENTING THE PRODUCER*

*REPRESENTING THE DIRECTOR*

*REPRESENTING THE SUPERSTAR*

*GETTING MONEY FOR YOUR MOVIE*

*LICENSING MOTION PICTURES*

*DIGITAL MOVIEMAKING*

*THE BUSINESS OF SPORTS*

*THE BUSINESS OF ENTERTAINMENT*

*SPORTS AND ENTERTAINMENT MARKETING*

*ADVERTISING, MARKETING, PROMOTION, SPONSORSHIPS, BRANDING AND HIP HOP CULTURE*

*HIP HOP AND THE SPREAD OF ISLAM*

*ISLAM AND MUSIC*

~Leon Powe’s “Powe Folks” Basketball Camp, Oakland, CA. 2006-8, ~ Lynn Harris’ “Fourth Quarter Athletics Basketball Showcase” (with Ashley and Courtney Paris(OU), Devanei Hampton (Cal), Alexis Gray-Lawson (Cal), Candice Wiggins (Stanford), Brooke Smith (Stanford), and Ashley Walker(Cal), Oakland, CA. 2006, Golden State Warriors Adonal Foyle’s “Athletics and Academics” Basketball Camp, Oakland, CA. 2006, ~Music in Islam, University of California, Berkeley, CA 2003~ National Islamic Convention, Seacaucus., NJ 1997,~ Host Evening of Elegance, National Arabic Conference, Oakland, CA. 1997,~ National Islamic Convention, N.Y.C, N.Y. 1996,~ International Islamic Conference, Los Angeles, CA. 1996,~ Oaktown Music Conference, Oakland, CA 1996,~ National Society of Black Engineers Conference-Region 6, San Luis Obispo, CA. 1992,~ CAREER FEST, Oakland, CA. 1986, ~ California State University, Hayward, CA. 1985,~

National Society of Black Engineers Conference-Region 6, San Luis Obispo, CA. 1992,~ CAREER FEST, Oakland, CA. 1986, ~ California State University, Hayward, CA. 1985,~  United States Coast Guard, Oakland, CA. 1982,~

United States Coast Guard, Oakland, CA. 1982,~ National BALSA Law Conference, Houston, TX 1981,~

National BALSA Law Conference, Houston, TX 1981,~![]() National BALSA Law Conference, Philadelphia, PA. 1982,~ National BALSA Law Conference, Oakland, CA. 1979,~

National BALSA Law Conference, Philadelphia, PA. 1982,~ National BALSA Law Conference, Oakland, CA. 1979,~ National BALSA Law Conference, N.Y.C., N.Y. 1980,~

National BALSA Law Conference, N.Y.C., N.Y. 1980,~ Mountain Regional Law Convention, Oklahoma City, OK. 1980,~ College of Alameda, Alameda, CA. 1981,~

Mountain Regional Law Convention, Oklahoma City, OK. 1980,~ College of Alameda, Alameda, CA. 1981,~ Eastern Regional Law Conference, Washington D.C. 1980,~ National Black Media Convention, Oakland, CA. 1972,~

Eastern Regional Law Conference, Washington D.C. 1980,~ National Black Media Convention, Oakland, CA. 1972,~ National BALSA Law Conference, Washington D.C. 1976,~

National BALSA Law Conference, Washington D.C. 1976,~  Pacific Coast Law Conference

Pacific Coast Law Conference , San Francisco, CA. 1976,~ Stanford Law Society, Palo Alto, CA. 1976,~ National Black History Week Awards, San Francisco, CA, 1974

, San Francisco, CA. 1976,~ Stanford Law Society, Palo Alto, CA. 1976,~ National Black History Week Awards, San Francisco, CA, 1974